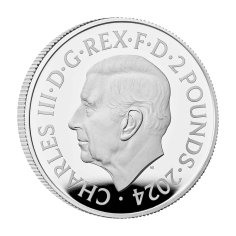

Silver collector coins

Silver collector coins are special editions of coins made of high-quality silver, intended mainly for collectors and investors. They play a unique role in numismatics, as they are items of not only material value due to the precious metal itself, but also artistic value. They are usually distinguished by their unique design, low mintage – which makes them unique – and high aesthetic value. They are often made to order, and their themes refer to important historical and cultural events or national symbols.

Sorting:

Price: from lowest

Bullion and collector coins – learn the differences

The Mint offers a wide range of gold and silver coins, including both bullion coins and collector coins. Many people—especially...

Go to blogRecommended products

Collecting silver coins allows you to explore history, culture, and the art of coinage, enriching your numismatic horizons. What's more, silver as a raw material is valued for its stable value, which means that collecting silver coins can be a way to secure your assets. Many coin editions can increase significantly in value over the years, especially when they are part of limited collections, making them a sensible form of investment.

Ultimately, owning silver collector coins is not only about securing future financial benefits, but also a way to expand your knowledge of culture and history through one of the oldest forms of applied art. It is also important to remember that coin collecting is simply a passion that is often passed on to future generations.

Types of silver coins

Silver coins come in various types, which serve different purposes and meet the diverse needs of collectors and investors. Each type has a different value and function – from coins with high investment value to unique, artistic pieces intended for numismatics enthusiasts. Below, we present the most important types of silver coins and their key features.

- Silver bullion coins are coins treated as investment products, whose value derives primarily from the amount of precious metal they contain. Most often issued in series, they contain pure silver in standard weights, such as 1 ounce or 2 ounces of silver. They are characterized by high liquidity on the market and are easily available. Examples available from the Mint of Poland include the Australian Kangaroo andthe Canadian Maple Leaf, which are valued by investors around the world. Issued by renowned mints such as the Perth Mint, they ensure the highest standard of precious metal purity, which increases their investment appeal.

- Collectible coins – these coins offer numismatic and artistic value in addition to the value of the metal they are made of. Their unique design and often limited number attract collectors and increase their value over time. Examples include Polish coins from the History of the Polish Złoty series or coins commemorating historical figures, such as the coin dedicated to Józef Piłsudski.

- Commemorative coins – their issuance is often linked to important events or anniversaries. They are distinguished by their unique design, reflecting the theme they commemorate. Examples include coins commemorating the 100th anniversary of Poland regaining independence or the anniversary of the Warsaw Uprising.

Each type of coin meets different needs – bullion coins are for investment purposes, collector coins provide historical and aesthetic value, and commemorative silver coins commemorate important events and figures. This makes the numismatic market diverse, allowing for an individual approach to investment and collecting.

Limited edition silver coins

Limited edition silver coins are unique items that are particularly prized by collectors. The limited number of coins on the market means that their market value increases over time, and their uniqueness attracts both investors and numismatics enthusiasts.

Limited edition coins are distinguished not only by their limited availability, but also by their unique design. Limited editions are issued to mark important historical moments and anniversaries and, due to their increasing collector's value over time, can be an excellent long-term investment.

Limited edition coins are a unique opportunity for collectors and investors looking for items with high collectible value and unique aesthetic features. The limited number of available pieces and special production technologies mean that their market price often increases over time, making them a profitable investment choice.

Silver as an investment

Silver has been considered one of the most valuable investment commodities for centuries. As a precious metal, it has a wide range of applications in both industry and jewelry, which keeps demand for it stable. Investment silver, especially in the form of coins, is valued by investors for its versatility and easy availability.

One of the main reasons investors decide to buy silver coins is to protect their capital in times of economic instability. The value of silver, like gold, tends to rise during periods of inflation or recession, making it an attractive hedge against a decline in the purchasing power of money. Silver is also a cheaper commodity than gold, allowing people with less capital to enter the investment market while offering the opportunity to diversify their portfolio.

Another advantage of investing in silver is its physical form, which gives investors a sense of security. Unlike investments in stocks or bonds, silver coins can be physically stored, eliminating the risks associated with digital transactions and long-term storage of funds in banks.

Investment silver, especially in the form of coins, is also highly liquid—meaning it can be quickly sold on the global market, making it an accessible and practical means of investing capital. Popular silver coins, such as those offered by the Mint, are easy to resell and their value is widely recognized both domestically and internationally.

Investing in silver also has the potential for growth in value. This metal is used in various sectors of the economy, including the modern technology sector, which increases demand for the raw material. It is predicted that demand for silver may increase in the future, which increases the chance of long-term profits for investors.

All these factors make silver an interesting investment alternative, offering stability, security, and potential for capital growth.

Certification and authenticity of silver coins

Certification and authenticity of silver coins are key elements for both investors and collectors. The guarantee of authenticity of silver coins allows collectors to be sure that each coin is made of high-quality material that meets international standards. In addition, certification ensures that the coin has a clearly defined composition and weight, which increases its value on the numismatic and investment markets.

To ensure that a silver coin is authentic, it is worth paying attention to several key factors. First of all, reputable mints offer coins with an accompanying certificate that confirms their quality and authenticity. Such certificates contain information about the silver fineness, weight, and details about the issue and serial number of the coin. For collectors, this is a guarantee that the coin comes from a legitimate source and meets the highest quality standards.

Certification also protects against counterfeiting, which poses a threat to the numismatic market. Mints offering silver coins of the highest quality often use additional security measures, such as special packaging or holograms, which increase the security of transactions.

For every collector and investor, a certified coin means investment security, prestige, and quality that enriches their collection.

(1)_LBMA.jpg)

801 501 521

801 501 521