Gold collector coins

Gold coins are valuable items that combine historical, artistic, and investment value. For centuries, they have been a symbol of wealth and prestige, and today they are an attractive form of capital investment. Thanks to limited issues and careful craftsmanship, collector coins are enjoying growing interest among both collectors and investors.

Investing in gold coins is not only a way to secure your assets, but also a source of satisfaction from owning unique works of art with lasting value.

Types of gold coins

Gold coins have been extremely popular among collectors and investors for centuries. Depending on their purpose, they can be divided into several basic types, which differ in terms of their characteristics, use, and value.

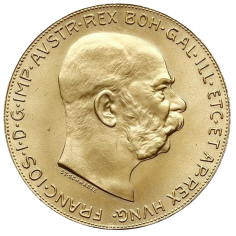

1. Gold collector coins – collector coins are special issues with unique designs, most often commemorating important figures, historical events, or cultural heritage. They are produced in limited quantities, which makes them extremely rare and sought after by collectors. They are characterized by high quality workmanship, often using proof technology, thanks to which every detail of the coin is precisely reproduced. Gold collector coins have investment, historical, and artistic value.

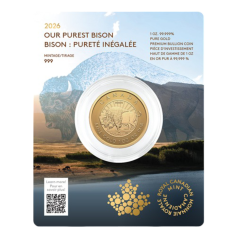

2. Gold investment coins – investment coins, also known as bullion coins, are produced primarily for investors. Their main purpose is to store value in precious metals. They are characterized by a high gold fineness, usually 999, which means almost pure gold content. Investment coins are issued in larger quantities than collector coins, and their price is closely linked to the current market value of gold. Popular gold investment coins include the Canadian Maple Leaf and the Krugerrand.

The name "bullion coins" comes from the French word "bullion," which means gold or silver in the form of bars or bullion intended for further processing. Bullion coins are therefore associated with storing value in bullion, mainly in gold and silver. Unlike circulation coins, which are used for everyday transactions, bullion coins are mainly used as a form of investment. Their value is based on the precious metal content, not the face value.

3. Commemorative gold coins – commemorative coins are issued to celebrate important events, anniversaries, or figures. They feature unique designs and are often produced in limited quantities, making them sought after by collectors. Examples of such coins include those issued to mark national anniversaries, sporting events, or historical events. Although they may have investment value, their main purpose is to commemorate important moments.

4. Historical gold coins - historical gold coins are real gems in the world of numismatics. These are coins issued many years ago, which have stood the test of time and are now extremely valuable due to their age, rarity, and condition. These coins have both numismatic and historical value, and their price often exceeds the value of the gold from which they are made. Examples include gold ducats and French Louis coins.

Collectible, investment, and commemorative gold coins all have unique uses and values. Collectors often seek out limited-edition coins that have historical and artistic value, while investors focus on bullion coins, whose value increases as the price of gold rises. Each of these types offers different benefits, making gold coins attractive to both numismatics enthusiasts and those seeking stable investments.

Features of high-quality gold collector coins

When choosing gold coins as an investment or part of a collection, it is worth paying attention to several key features that determine their value and quality. The highest quality gold coins are not only a guarantee of beautiful craftsmanship, but also a solid investment.

1. Purity of the metal – one of the most important criteria for evaluating gold coins is their purity, i.e., the content of pure gold. The highest quality coins have a gold fineness of 999 or 999.9 (24-carat gold), which means almost 100% pure gold. It is worth paying attention to this parameter, because the higher the purity of the metal, the greater the investment value of the coin.

2. Certificate of authenticity – each coin should come with a certificate of authenticity confirming its origin, gold content, and limited mintage. The certificate guarantees that the coin has been minted in accordance with the highest standards, which further increases its market value. Without a certificate of authenticity, investors may find it difficult to verify the value of the coin, which may affect its subsequent sale.

3. Careful craftsmanship – careful craftsmanship in coin production is of great importance, especially in the case of collector and investment coins. Coins with clear, precisely reproduced details, a smooth surface, and well-defined edges indicate high quality. The process of minting gold collector coins often involves the use of proof technology, which further enhances their aesthetic appeal.

4. Limited mintage – the value of gold coins may also be related to their mintage. Coins produced in limited quantities, e.g., as part of commemorative series, are more sought after by collectors. Limited availability on the market affects their value, which may increase over time.

Choosing gold coins of the highest quality is not only a matter of aesthetics, but above all a conscious investment. By choosing coins with high purity, careful workmanship, and a certificate of authenticity, investors can be sure that their purchase will be valuable both financially and as a collector's item.

Investing in commemorative gold coins

Investing in gold coins has been a valued form of capital investment for centuries, offering a number of benefits to investors and collectors alike. One of the key advantages of this investment is capital protection.

Unlike fiat currencies, whose value is based on trust in the issuer, e.g., the government and state regulations, rather than on their actual material value, as in the case of gold or silver, gold is not subject to inflation or significant exchange rate fluctuations, making it a safe asset in times of economic uncertainty. Investing in gold coins is an effective way to protect your assets from losing value, which is particularly important in the face of global economic crises.

Another significant advantage is the potential for gold coins to increase in value over time. Gold has always been in high demand, and its market price rises in the long term. Gold coins can increase in value not only because of the rise in the price of the metal itself, but also thanks to their unique features, such as limited editions, exceptional designs, or historical significance. These factors increase their appeal to collectors, which in turn can bring significant profits to investors.

Investing in gold coins also offers the opportunity to apply various investment strategies. One of them is long-term storage of gold as a safe asset that gains value over time.

Investors may also treat gold coins as part of a diversified portfolio, protecting themselves against the risks associated with other types of assets, such as stocks or bonds. Gold coins are also characterized by high investment liquidity—they are easy to store and, if necessary, can be quickly sold and exchanged for cash almost anywhere in the world.

It is also worth paying attention to collector coins, which, apart from the value of the precious metal, gain in price due to their uniqueness and limited circulation. For many investors, they are a form of capital security and, at the same time, a way to increase profits, as their value can significantly exceed that of standard investment coins.

In summary, investing in gold coins is a way to protect your capital and potentially generate profits in the long term. Thanks to a variety of strategies and investment flexibility, gold coins are an attractive option for both novice and experienced investors.

Summary and future of investing in gold coins

Investing in gold coins is a proven way to protect your capital, which has been appreciated by investors for centuries. Gold, as a precious metal, has a lasting value, which makes it a solid hedge against inflation and financial market instability.

Gold coins offer material value and unique collectible value, especially in the case of limited editions. Thanks to its liquidity and global recognition, gold is easy to sell in almost every corner of the world, which further emphasizes its investment appeal.

The future of investing in gold coins looks promising. In the face of a changing economic situation and global financial tensions, gold remains a safe haven. The growing interest in investing in precious metals, resulting from the need to protect capital, contributes to the stable development of this market. It is predicted that the price of gold may continue to rise in the coming years. In reality, this means that investing in gold coins is becoming even more profitable.

In summary, gold coins are not only a means of long-term financial security, but also an investment with high growth potential. Thanks to its stability, ease of storage, material value, and collectability, gold is a product worth adding to your investment portfolio. Investing in gold coins is an effective way to protect your capital and secure your future.

(1)_LBMA.jpg)

801 501 521

801 501 521