- Author of the entry: Mennica Skarbowa

- Date of entry:

Most gold investment products are sold by weight in ounces. This refers to the troy ounce, which is accepted as the standard measure in international trade. What exactly is it, and how many grams are there in 1 ounce (oz.)? Read our article to learn more about the value of the royal metal: gold bullion coins and LBMA investment bars.

Investment gold and its measure: the troy ounce

Regardless of whether we are talking about jewelry gold orinvestment gold in the form of gold bullion coins, collector's coins, and gold bars, the same system of measurement always applies to this precious metal. We are talking about the ounce, which is calledthe troy ounce. It is important to use the full name because the gold market also uses the imperial ounce, which is used for various commodities in the Anglo-Saxon system. However, it is important to remember that refineries, mints, and certified distributors offering products manufactured by organizations affiliated with the LBMA always use the troy ounce.

How many grams are in a troy ounce?

One troy ounce is exactly 31.1034768 grams. Due to this decimal remainder, the troy ounce is easier to use in international trade and is also valid in countries that have adopted the decimal system.

It is important to maintain uniformity of measurement in international trade, which is why the troy ounce is still widely used. At the same time, thanks to the decimal system, the weight of gold can be accurately converted into grams.

Recording the weight of investment products in gold

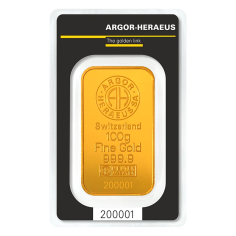

The weight of gold, or more precisely its weight often given in ounces, is the basic element determining the value of a given investment product. Anotherfactor is, of course, the purity, with 999.9 being the highest. What weight specifications can be found when buying gold bullion coins and gold bars? Here are a few examples from the Mennica Skarbowa online store:

- 1 ounce Gold bar 10 ounces Gold bar

- Gold coin Year of the Dragon 2024 1/20

- Canadian Maple Leaf Coin 1/10 oz Gold

- Britannia 1/4 oz gold coin

- Vienna Philharmonic Coin 1/2

- Australian Kangaroo 1 oz gold coin

When are gold investment products quoted in grams?

Many manufacturers of gold bullion coins and gold bars are aware that not every investor is familiar with the troy ounce measure. Therefore, not only investment products marked in ounces are available for sale, but also those marked in grams, which we are all familiar with. Examples of such bars and coins are presented below:

Market value of gold – spot price and distributor price

The market value of gold is primarily quoted in US dollars per ounce. Currently, as of early March 2024, the price of gold is close to $2,040 (SPOT price of the metal). Converted into Polish zlotys, gold is currently worth approximately PLN 8,145. How much is a gram worth? A gram of gold, according to the current market price of the metal, is worth approximately PLN 262. A kilogram of gold, according to its market value, is valued at over PLN 261,868. However, it is worth remembering the small margins of distributors and the additional costs included in the final price of a given investment product. For example, our one-kilogram bar is valued at PLN 266,029.

What affects the market value (SPOT price) of gold?

There are many factors that influence the market value of gold and itsSPOT pricequoted on exchanges. First and foremost, however, are supply and demand. When supply is low and demand is high, the price of gold rises rapidly. In addition, its value is influenced by production costs, limited global reserves of this metal, and, of course, the global economic situation – in this context, it is worth noting three interesting correlations!

The value of gold and inflation

Periods of global inflation usually bring significant increases in the gold market. Already this year, the precious metal may exceed USD 2,100 per troy ounce, which is due to high demand and the stable value of the metal. It is not susceptible to economic crises and is considered a safe haven for investment.

The value of gold and the US dollar

The value of gold correlates inversely with the US dollar. This means that when the purchasing power of the USD declines, the price of gold rises. However, investors need not fear that gold will become cheaper if the dollar strengthens. Drastic declines are rarely seen in the gold market.

The value of gold and economic crises and monetary policy around the world

Gold thrives during economic crises, and central banks' decisions on interest rates contribute to its increased value. Money printing, gold purchases by banks, and the general monetary policy of developed and developing countries mean that gold could be worth as much as $3,000 per troy ounce in 2030!

(1)_LBMA.jpg)

801 501 521

801 501 521