- Author of the entry: Mennica Skarbowa

- Date of entry:

Gold gained value last week. This was the result of Wednesday's announcement by the Federal Reserve. What next?

The price of gold rose by more than $26 per ounce in just a few hours. This was thanks to dovish macroeconomic projections. The dovish statement from the FOMC (Federal Open Market Committee) also played a role. Fed Chair Janet Yellen raised the federal funds rate by 25 basis points, which was in line with market expectations. The increase was almost entirely discounted, so investors focused mainly on macroeconomic projections. Of particular importance to them is the so-called dot chart (i.e., projections of the optimal interest rate level). The Fed plans two more interest rate hikes this year. However, it noted that the pace of the hikes will be slow. The market clearly expected more.

Yellen emphasized that the risks to inflation are symmetrical. Compared to the previous meeting, the Fed chair's statement lacked optimistic tones. The effects were not long in coming. The dollar sold off against G-10 currencies, and gold, which is strongly inversely correlated with it, took advantage of the situation and rose by about 2% in a single session. At the same time, yields on 10-year US government bonds fell from around 2.59% to 2.50%. At the beginning of this week, the declines deepened to 2.47%. This is generally good news for commodities, including gold. A weak dollar will be a driving force for gold. Now, wage growth signals and specifics related to the tax cuts announced by the Trump administration may be key for the dollar and gold.

Political risk on the Old Continent, Trump, and the start of the Brexit process present an opportunity for precious metals

In recent years, increases in the gold market in the first months of the year were caused by capital inflows into ETFs. This year, the January-February increases are the result of political uncertainty in Europe and the United States. The US president can surprise the market at any moment. Trump is even more unpredictable than the weather in March in Poland. Risk aversion may also increase after the elections in France and Germany. During the elections in the Netherlands, the populist party did not cause a sensation. Optimists say that the Dutch have proven that support for Eurosceptic factions is not becoming a pan-European trend. In the French elections, Le Pen is a threat, whose election promises are a kind of attempt to dismantle the European Union, which she herself says openly and loudly. The start of formal Brexit is being delayed, which may cause tensions and provoke even greater risk aversion among investors. Although the Brexit bill has been signed by the British Queen, Prime Minister May is in no hurry to start the process. In addition, European politicians are coming up with various reasons to slow down negotiations on the UK's departure from the EU.

CFTC Reports

The CFTC report shows that in the week preceding the Fed meeting, investors reduced their long positions in gold by almost 50% to 46,374 contracts. At the same time, the number of net contracts fell to its lowest level since January 2017. This behavior on the part of investors was caused by expectations of a stronger dollar following Wednesday's announcement.

Gold technically

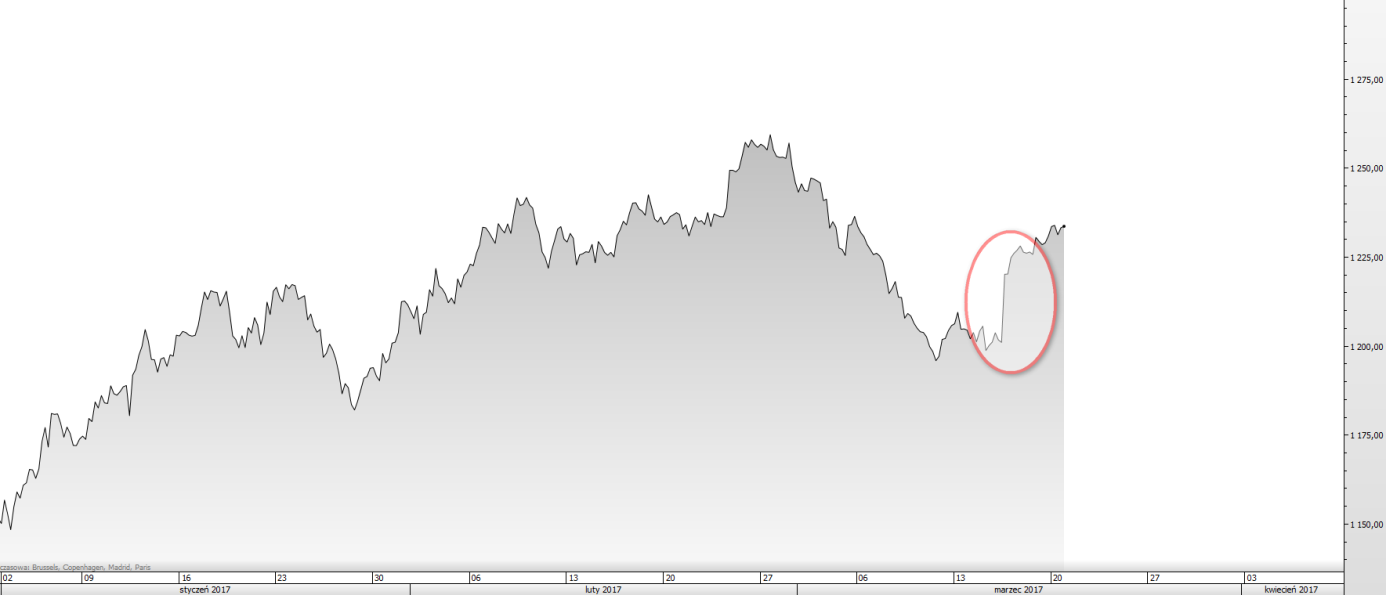

Since December 2016, gold has been following an upward trend. The declines, which began in early March and lasted for two weeks, brought gold to $1,195 per ounce. The 50% retracement level of the two-month gains proved to be a strong support. The point at which the declines slowed down was also determined by the equality of the downward impulses that occurred in the first half of March. However, the long-term upward trend will only be confirmed when the highs from the end of February are broken and the price returns to the upward channel.

Arkadiusz Kłosiński

Mennica Skarbowa S.A.

(1)_LBMA.jpg)

801 501 521

801 501 521