Your shopping cart

No products in the shopping cart

- Author of the entry: Mennica Skarbowa

- Date of entry:

The results of the first round of the presidential election in France caused financial markets to breathe a sigh of relief. Emmanuel Macron won with 23.75% of the vote, while Marine Le Pen also advanced to the second round with 21.53%. Risky assets are gaining ground, while "safe havens" are losing ground.

Gold, the Japanese yen, and the Swiss franc are under pressure today. European indices are climbing (WIG20 +1.4%, DAX +2.85%), and the single currency is also gaining. At the opening, the EUR/USD pair gained over 200 points.

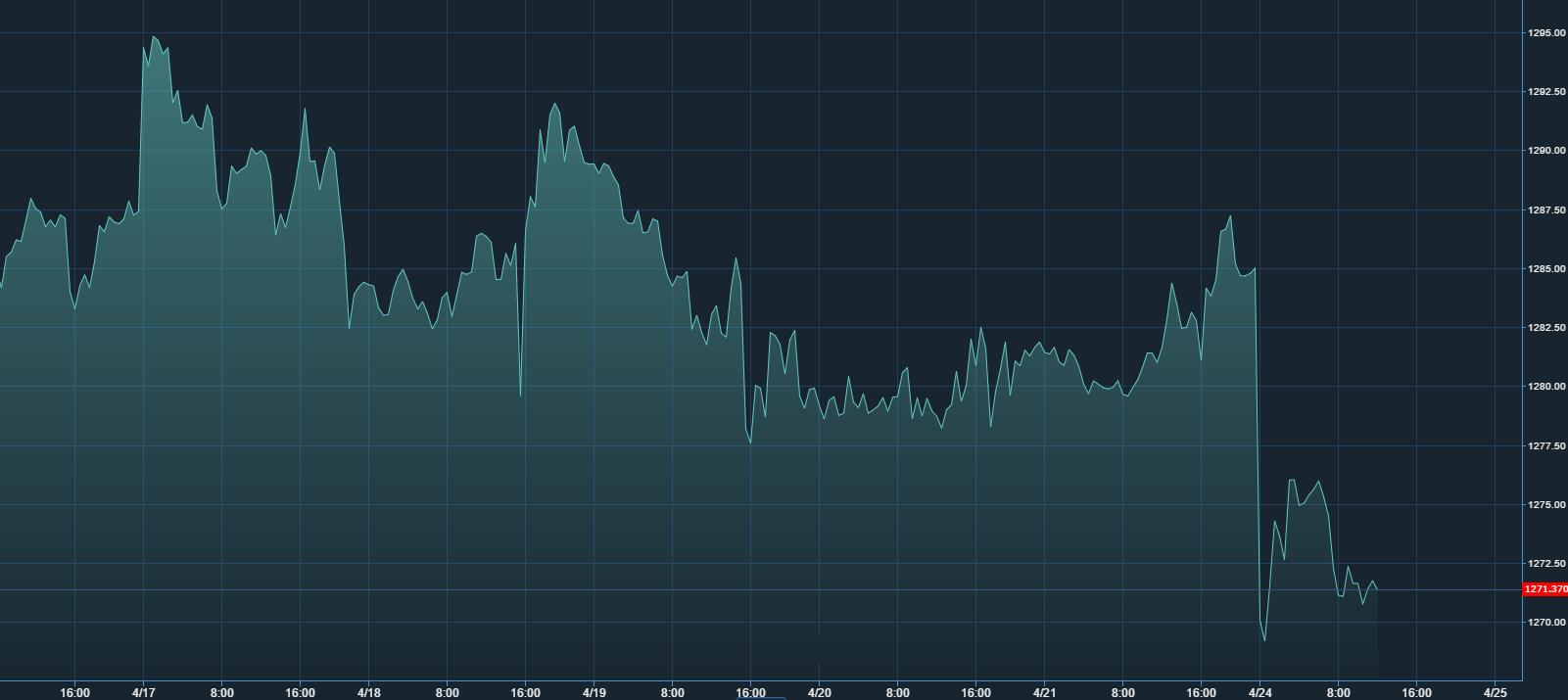

Gold prices initially fell to $1,269 per ounce, but recovered during the night and early morning hours. However, we are currently seeing a continuation of the sell-off.

Commodity currencies (AUD, NZD, CAD) and emerging market currencies (PLN, HUF, RUB) benefited from the election news.

Currently, we are seeing euphoria in the markets. We can see that risk appetite has returned and may be maintained until the final results of the second round of the French elections, which is scheduled for May 7.

Chart: Gold's reaction to the French election results

Gold, the Japanese yen, and the Swiss franc are under pressure today. European indices are climbing (WIG20 +1.4%, DAX +2.85%), and the single currency is also gaining. At the opening, the EUR/USD pair gained over 200 points.

Gold prices initially fell to $1,269 per ounce, but recovered during the night and early morning hours. However, we are currently seeing a continuation of the sell-off.

Commodity currencies (AUD, NZD, CAD) and emerging market currencies (PLN, HUF, RUB) benefited from the election news.

Currently, we are seeing euphoria in the markets. We can see that risk appetite has returned and may be maintained until the final results of the second round of the French elections, which is scheduled for May 7.

Chart: Gold's reaction to the French election results

Arkadiusz Kłosiński

Mennica Skarbowa S.A.

Mennica Skarbowa S.A.

(1)_LBMA.jpg)

801 501 521

801 501 521