Your shopping cart

No products in the shopping cart

- Author of the entry: Mennica Skarbowa

- Date of entry:

Gold market analysts from the world's largest institutions have long been warning that global gold production will decline. Now, Metals Focus has spoken out, reporting that gold supply has already decreased significantly this year.

There are many reasons for the decline. As usual, money is the most important factor. After the peak in September 2011, when gold mining was an extremely lucrative business, the profitability of mines has fallen along with the price of gold. And these mines, exploring available deposits and digging deeper and deeper, incur increasingly higher costs, often exceeding even $1,000 per ounce.

Some of the large mining projects launched at the beginning of this decade have been abandoned, but in some cases—such as the Pueblo Viejo mine in the Dominican Republic—the expenses incurred have forced mining companies to continue with unprofitable operations.

Despite adversity, gold mining has seen slight increases each year to meet the huge demand for the precious metal. Since 2006, it has grown by approximately 30 percent and, according to data from the World Gold Council, amounted to 3,236 tons last year. China, Russia, and Mexico are primarily responsible for this result. New projects in Africa and a rebound in production in Canada and Australia also contributed to the increase.

Now, however, it may turn out that the peak in gold supply from global mines is already behind us. According to Metals Focus analysts, gold production fell by 0.4% in the first quarter (year-on-year), which may seem like a small decline, but experts consider it to be the beginning of a trend. GFMS and CPM Group analysts also admit that they expect a decline in production, which is expected to accelerate around 2020.

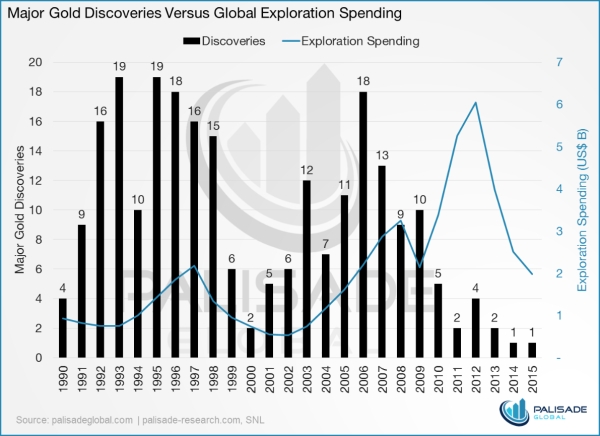

It is worth noting that even in the event of a significant increase in prices, leading to higher mine profitability, the lack of new discoveries remains a problem (see chart above). The largest expenditure on gold exploration was in 2012, when mining companies spent as much as $6 billion on exploration. A decade ago, 18 new significant deposits (i.e., those with an estimated content of one million ounces) were discovered worldwide. Today, such discoveries occur on average once a year.

The question remains how quickly the decline in mining—which today accounts for nearly 71 percent of total gold supply—will affect gold prices.

MW

(1)_LBMA.jpg)

801 501 521

801 501 521