Your shopping cart

No products in the shopping cart

- Author of the entry: Mennica Skarbowa

- Date of entry:

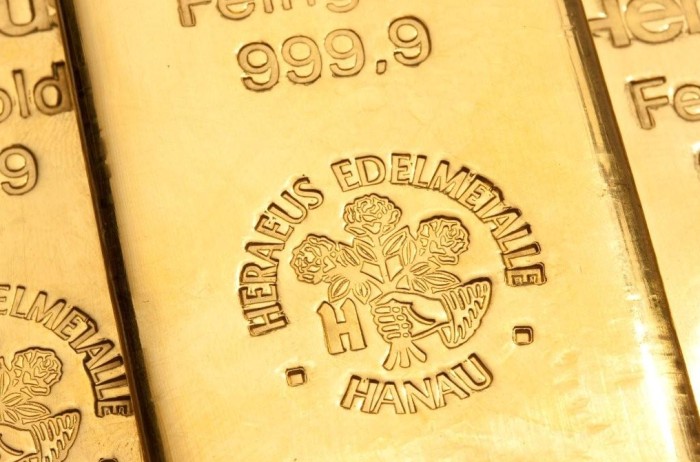

One of the world's largest gold processors and producers, the German Heraeus Group, is acquiring the equally renowned Swiss company Argor-Heraeus, according to Western media reports.

Their merger will make Heraeus a true giant in the gold market. According to its representatives, it will become the most powerful metal supplier in the world.

(src: https://www.heraeus.com)

The story of the golden giant

The Argor-Heraeus Mint has been in existence since 1951 and was included in the list of LBMA-accredited producers just one year later. It has been producing bars marked "Good Delivery" since 1961. In 1973, it was acquired by the Swiss bank UBS, and since 1986, the German family-owned company Heraeus has also held shares in it.

When UBS withdrew from its involvement in the mint in 1999, 33% of the shares remained in the hands of Heraeus, 32.7% were purchased by Commerzbank, and 30% went to the Austrian Mint. The remaining shares remained in the hands of the Argor-Heraeus management board. Now, following the final approval of the new transaction, Heraeus will become the owner of 100% of the shares.

The first rumors about the sale of a majority stake in Argor-Heraeus appeared last year, but at that time the expected price proved too high and the finances of those interested in the purchase were not transparent enough.

Valuable infrastructure, experience, and prestige

Heraeus currently accounts for approximately 10 percent of the total gold production of the world's seven largest refineries. By acquiring the Swiss refinery, it will not only gain another prestigious brand, but also valuable infrastructure necessary to increase production.

Argor-Heraeus, based in Mendrisio, Switzerland, has facilities in Italy, Germany, Chile, Hong Kong, and the US, among other places. They are primarily involved in refining gold obtained from mines and recycling, but also in the production of bars, coins, and semi-finished products.

In a statement issued by Heraeus, its CEO, Jan Rinnert, said that the decision to acquire Argor was primarily based on the company's experience in gold and silver production, as Heraeus itself specializes in the processing of platinum group metals.

Heraeus was to pay "several hundred million euros" for its stake. It is difficult to assume that it decided to make such a move without believing that gold was really going through a good period.

(1)_LBMA.jpg)

801 501 521

801 501 521