- Author of the entry: Mennica Skarbowa

- Date of entry:

The drastic measures taken by the Indian authorities to combat the black market have shaken both the country's economy and global demand for gold. The decision to demonetize 15 trillion rupees (nearly $220 billion) has had a particularly significant impact. It is clear that the gold market in India, until recently the largest in the world, is currently struggling, but ultimately the reforms introduced by the Indian government are expected to have a positive impact on the economy. This should bring the demand for gold in the country to 650-750 tons this year, according to today's special report by the World Gold Council (WGC).

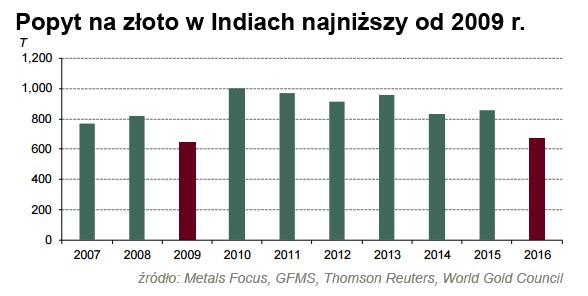

Last year, demand for gold in India fell to its lowest level since 2009. New reforms caused some citizens to suddenly refrain from buying gold, while poor sentiment in rural areas and rising gold prices effectively discouraged others. Global demand for gold suffered significantly as a result.

What actually happened? On November 8 last year, the Indian government announced the cancellation of 500 and 1,000 rupee banknotes and ordered them to be deposited in local banks by the end of the year. The reform was widely referred to as demonetization. The 1,000 rupee denomination was completely eliminated, and improved 500 rupee banknotes were introduced to the market, as well as completely new 2,000 rupee banknotes. The government was guided by the need to bring illegal money back into the economy, but the economy initially reacted negatively. According to official data, by February 17 this year, only 70% of the currency withdrawn from circulation had been issued in new banknotes.

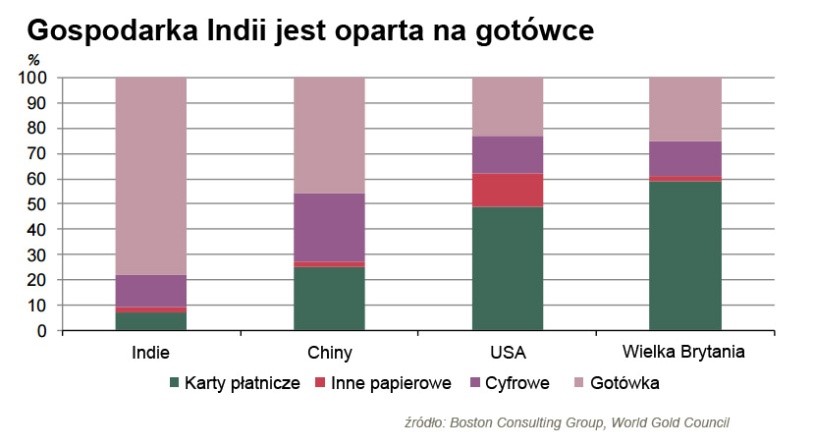

This liquidity problem has affected the economy. According to the latest data from 2012, the so-called "informal" sector, which is almost entirely cash-based, accounted for 85% of non-agricultural employment in the country. It is therefore no surprise that the withdrawal of some of the money from circulation has had a clear impact on it. Domestic motorcycle sales, which are an excellent indicator of the health of rural areas, fell by half in December.

However, the tense situation in the world's second-largest gold consumer is set to improve soon. As WGC experts note, the funds deposited by citizens in banks will increase the lending capacity of these institutions, which should have a positive impact on the economy. Consumption is also expected to be supported by increases in pensions and public sector wages. Incomes in rural areas are also likely to rise as a result of last year's monsoon season, which was the most favorable for farmers in three years.

The government's move towards greater transparency in national finances should have positive effects in the long term. It is worth noting that currently only 2% of the population in India pays income tax. Looking even further ahead, we can also expect beneficial effects from the so-called "demographic dividend," i.e., the huge number of young people entering working age.

According to the World Bank, this should help India achieve economic growth of 7.8% as early as 2019. And such growth can only mean benefits for the global gold market.

Marianna Wodzińska

Head of Trading

Mennica Skarbowa S.A.

(1)_LBMA.jpg)

801 501 521

801 501 521