- Author of the entry: Mennica Skarbowa

- Date of entry:

Over the past three decades, gold mining has doubled, and the amount of gold in global circulation today is approximately 190,000 tons. To put this into perspective, this corresponds to a cube with edges 21 meters long. Will the amount of gold mined double again in the next 30 years? Or will it at least remain at the current level of production? Everything indicates that this will not be the case.

Thirty years ago, the gold market looked completely different than it does today. The leading producers were the "big four": South Africa, the United States, Australia, and Canada, which together accounted for 60% of global production. Today, their share of global production is only 30%, and Latin America, Africa, and Asia are becoming increasingly important. In 2007, China took the lead in the global ranking, and in 2016, Russia moved up to third place.

While some deposits began to run out, others found real gold veins. The problem is that they too will soon face an obvious problem – valuable deposits are not bottomless. According to a 2016 study, global gold reserves that can be mined amounted to just over 55,000 tons. This means that at current mining rates, there is only enough gold left for 15 years. However, there are also deposits—even twice as large—that we cannot reach today.

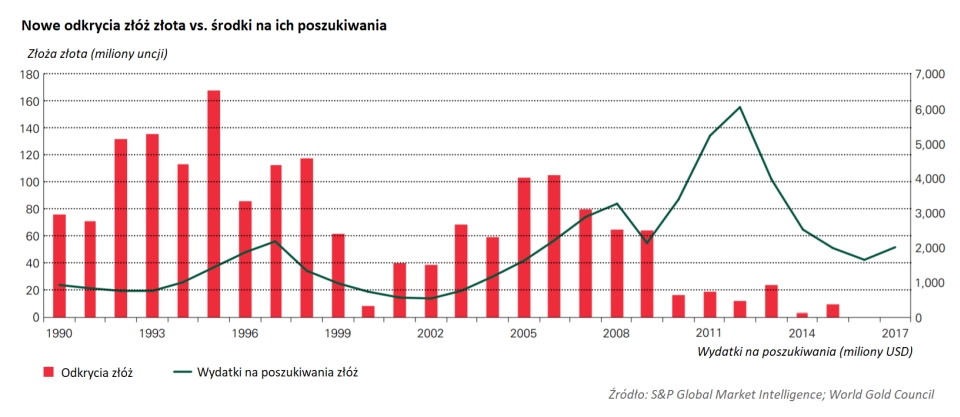

The obstacle to obtaining them is not only the available technology, but also profitability. Mining costs are rising year on year, while budgets for new exploration are falling. The lack of success (see chart below) does not encourage further exploration. According to estimates by the World Gold Council, taking into account only the deposits available today, maintaining the current level of production would require prices of around $1,500 per ounce.

The problem with declining supply also lies in financing exploration on individual continents. The largest budgets are still allocated to projects in heavily exploited Australia, Canada, and the United States, while only 15% of global funds are spent in Africa, which is potentially rich in deposits. Why? Africa is still not conducive to exploration, due to both political considerations and poor infrastructure—primarily difficult access to electricity and water, as well as a lack of qualified personnel.

Gold production forecasts for the coming years are also influenced by the method of extraction. Today, underground mines with deep shafts account for only about 25% of all mines, and it is at great depths that the deposits with the highest gold content are found. Since the 1970s, when gold was sought at greater depths, the average amount of grams extracted from a ton of rock has fallen from 10 to just 1.4 g. To achieve results similar to those once obtained in the famous Witwatersrand deposits in South Africa, gold mined today, mainly in open-pit mines, requires more work, equipment, and time.

What next? Forecasts say that peak production is already behind us, and the future will bring further declines. However, technology may come to the rescue, because today, 30 years is almost an entire era.

Data based on GFMS – Gold Survey, World Gold Council

(1)_LBMA.jpg)

801 501 521

801 501 521