Today, everyone is looking for the perfect investment vehicle. There is no such thing as one that is without flaws. However, observing the behavior of global markets, it is worth putting your trust in gold.

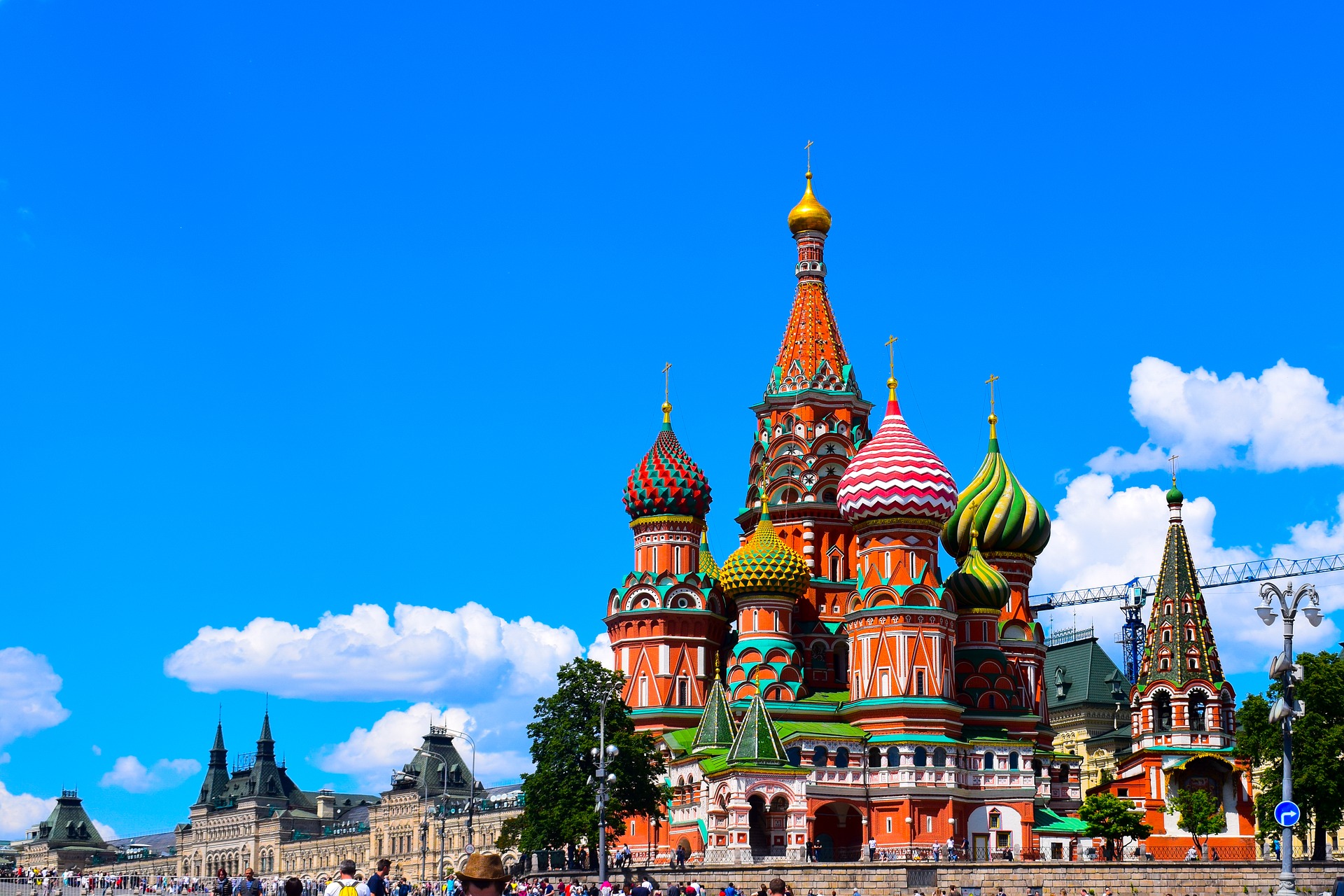

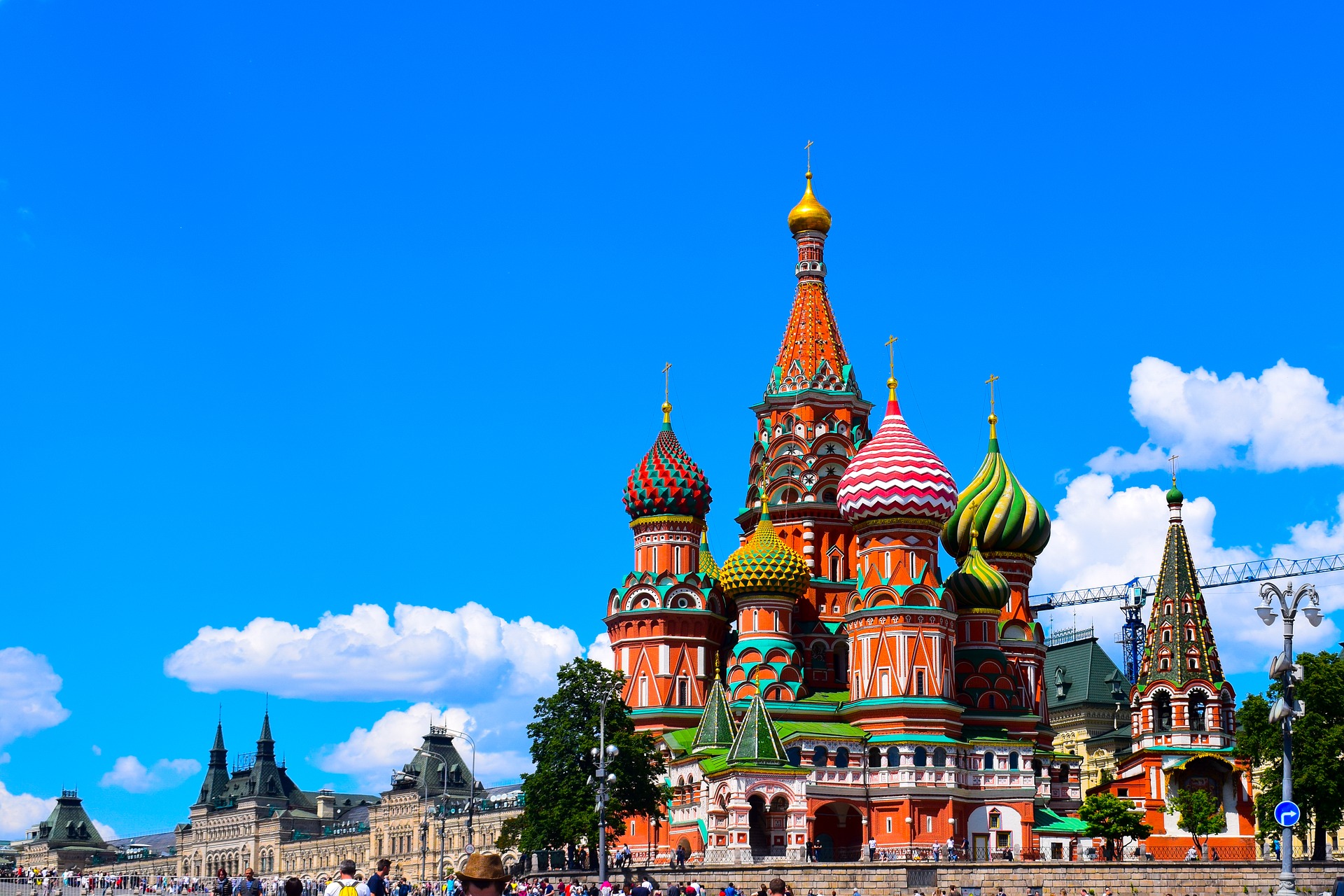

According to the latest reports, Russia is increasing its gold reserves. According to financial market analysts and the International Monetary Fund, Moscow has the potential to become the third largest holder of gold reserves in the world within a decade.

The World Gold Council (WGC) has published a report that clearly indicates that the Russian Federation is systematically increasing its gold reserves. In September alone, it purchased an additional 400,000 troy ounces, which translates to 12.44 tons. This is not an impressive jump compared to the reserves increased over the last three years, but it has a significant impact on Moscow's position on the international stage. Russia currently holds 2,234 tons of gold. This places the country in fifth place among the listed national economies.

According to many market analysts and simulations conducted by the IMF, such a rate of growth in reserves could contribute to Russia becoming the world's third largest holder of gold reserves within a decade, right after the US and Germany.

Why is Russia investing in gold?

The systematic expansion of reserves is dictated by several economic factors and is a consequence of the Kremlin's policy.

Vladimir Putin is striving to make the national economy independent of the US dollar. This is a response to the actions of Donald Trump's administration. Russia is reducing its reserves in this currency. It is also striving to export oil and other raw materials in currencies other than the dollar.

Furthermore, according to many, Russia anticipates a crisis on global markets. The Kremlin assumes that gold will play a key role at that time. Another major player that cannot be overlooked is China. Alongside Australia and Russia, China is one of the world's largest gold producers. These countries have the ability to increase their reserves based on their own production. In doing so, they do not openly influence global markets and the price of gold.

According to global market analysts, these two issues have a dominant influence on Russia's behavior.

It is worth mentioning that the National Bank of Poland has also increased its gold reserves over the past two years. This was the first such large purchase of gold in Poland in 20 years and the first among European Union countries in the 21st century.

Perhaps this should be a clue for us as to what is worth investing in and what we should invest in?

(1)_LBMA.jpg)

801 501 521

801 501 521