- Author of the entry: Mennica Skarbowa

- Date of entry:

The decline in the price of gold triggers an avalanche of purchases.

Since the end of last week, we have been observing a significant decline in gold prices. Last Friday, the price of gold fell by 5%. On Monday, prices slumped by as much as 9%. It would seem that this would cause drama on the physical gold markets. After all, the nightmare that some analysts and the media have been predicting for several years has come true: "the end of the gold bubble."

However, in the case of physical gold trading, this has only led to increased demand. Customers who have been observing the horizontal trend in gold prices over the past few months are taking advantage of this moment to make purchases. And these are not only new customers, but also those who already invested in gold last year and two years earlier at significantly higher price levels.

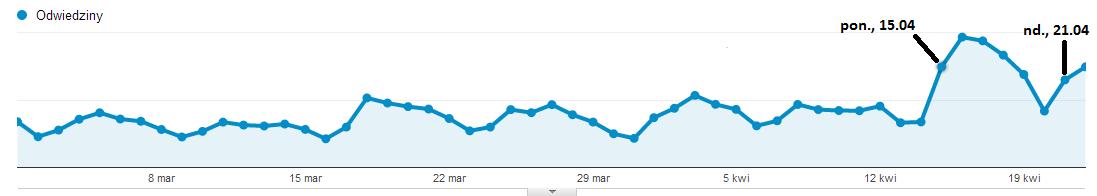

Visiting an online gold store www.MennicaSkarbowa.pl between January 1, 2013, and April 17, 2013.

Source: Google Analytics for www.MennicaSkarbowa.pl

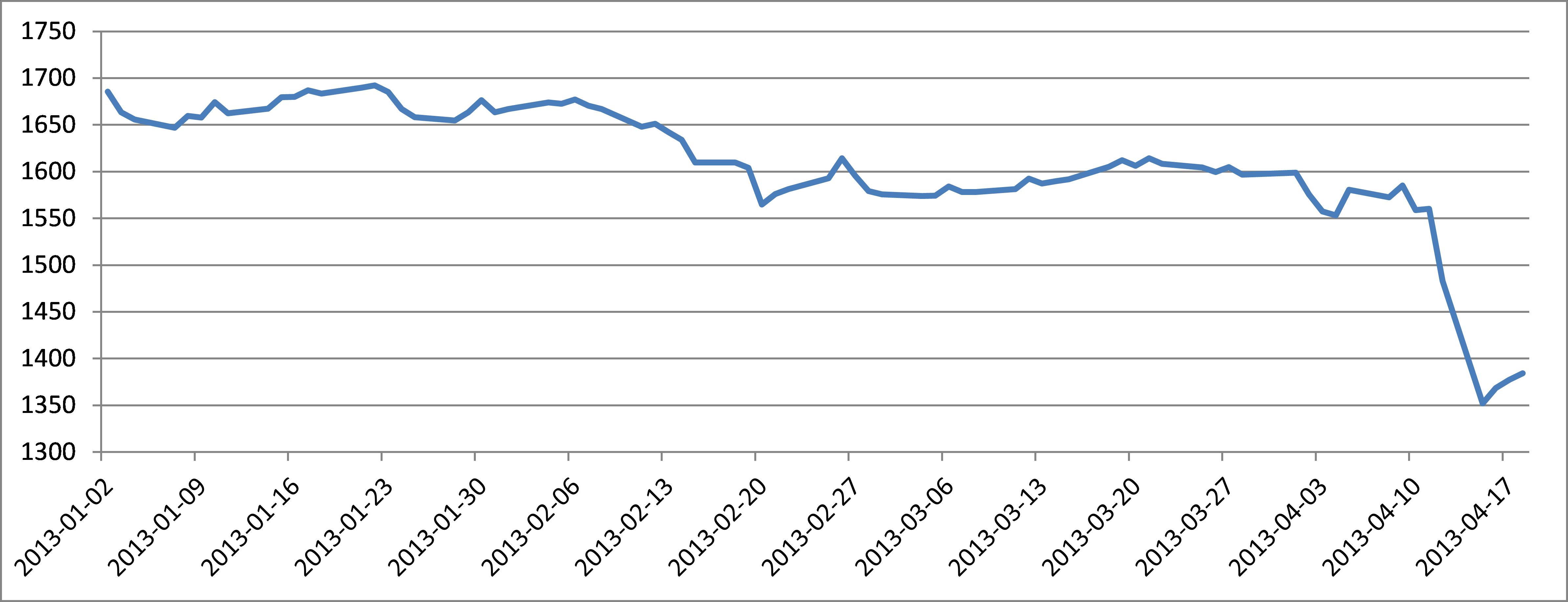

Gold price chart for the period from January 1, 2013, to April 17, 2013 (in dollars per ounce)

Source: Own study based on data from www.Stooq.pl

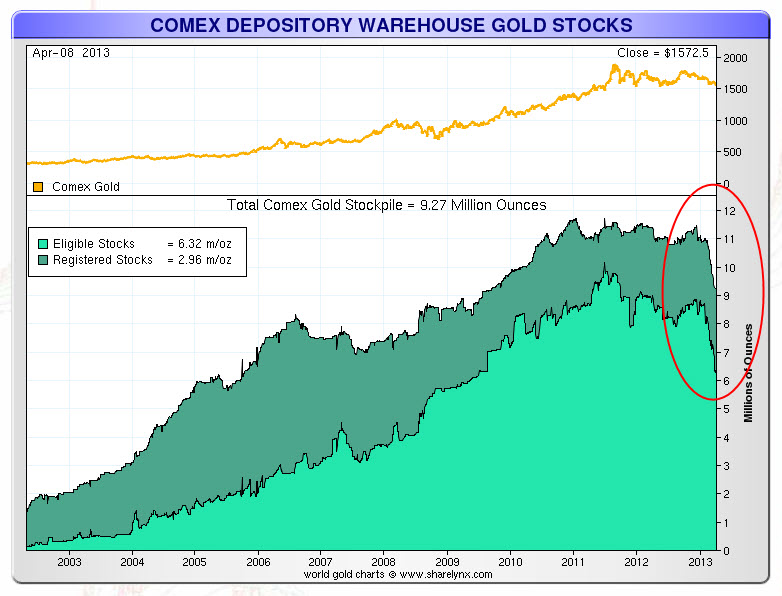

After analyzing the above charts, a question immediately comes to mind. Since customer interest in gold has increased so much as a result of the price decline (a 2-3-fold increase in visits to online stores selling gold, a more than 5-fold increase in turnover), prices should rebound just as quickly and the price of gold should rise rapidly. But this is not happening. On Tuesday, prices rose by 1.2%, and on Wednesday by 0.6%. Why so little? This is due to the fact that gold traded on exchanges has broken away from the physical market and repeatedly exceeded it. On Black Monday alone, trading on the largest gold futures exchange, Comex, exceeded 2,100 tons. This is a record for this exchange and is roughly equal to the total annual sales of investment gold to private individuals, institutions, and central banks. This is slightly less than the entire annual production of 2,600 tons. In the early 2000s, annual trading on the Comex exchange was about 10 times the annual gold production. Since the end of the last decade, however, this figure has risen to about 50 times the annual production. At the same time, physical gold stocks on the Comex exchange, which had been growing along with trading volume until 2010, began to decline in the new decade, and in 2013 this decline gained momentum. Currently, they amount to only 2,500 tons (9 million ounces), which is a small percentage of the trading volume on the exchange.

Gold reserves in Comex warehouses from January 1, 2002, to April 8, 2013 (in millions of ounces, 1 million ounces = approximately 280 tons)

What is the reason for this decline in gold reserves? It is precisely the lack of confidence in markets and financial institutions. The recent case of Cyprus has shown how little our paper savings may be worth. Gold, on the other hand, is the only reliable currency that can always be exchanged for other goods. Of course, this is provided that we have it in physical form. This opinion is shared, among others, by the German central bank, the Bundesbank, which asked the United States for the opportunity to audit the 1,500 tons of gold reserves stored in the Federal Reserve (the US central bank). The Americans refused, as a result of which Germany stated that in that case it would demand the return of its gold. However, the most shocking thing about all this is the deadline for the return: 2020. It is puzzling that it cannot be done earlier.

In this respect, we can see that physical gold is not a speculative bubble at all. What is more, when someone finally tries to calculate how much physical gold there actually is and how much has been sold in the form of worthless paper, the price of physical gold is likely to skyrocket.

However, we should also remember not to treat gold solely as a form of investment. To a much greater extent, gold is our insurance against bad times and a hedge against inflation and reckless printing of paper money. It is worth noting that this money printing has caused the US stock market indices (DJIA and S&P500) to reach their historic highs. Does this mean that the crisis is over and we have a bright future ahead of us? On the contrary, we have a speculative bubble on most assets, caused by too much paper money on the market and growing global debt. Gold is the only security that will protect us when this bubble bursts. The central banks of individual countries know this, having purchased a record 500 tons of physical gold last year. Fortunately, informed private investors also know this and are taking advantage of price drops to replenish their precious metal reserves.

Bartłomiej Knichnicki, managing director of MennicaSkarbowa.pl

The author is a PhD student at the University of Economics in Wrocław in the Department of Financial Investments and Risk Management. In addition, he runs the consulting company Volante Sp. z o.o. and is the managing director of MennicaSkarbowa.pl.

(1)_LBMA.jpg)

801 501 521

801 501 521