Your shopping cart

No products in the shopping cart

- Author of the entry: Mennica Skarbowa

- Date of entry:

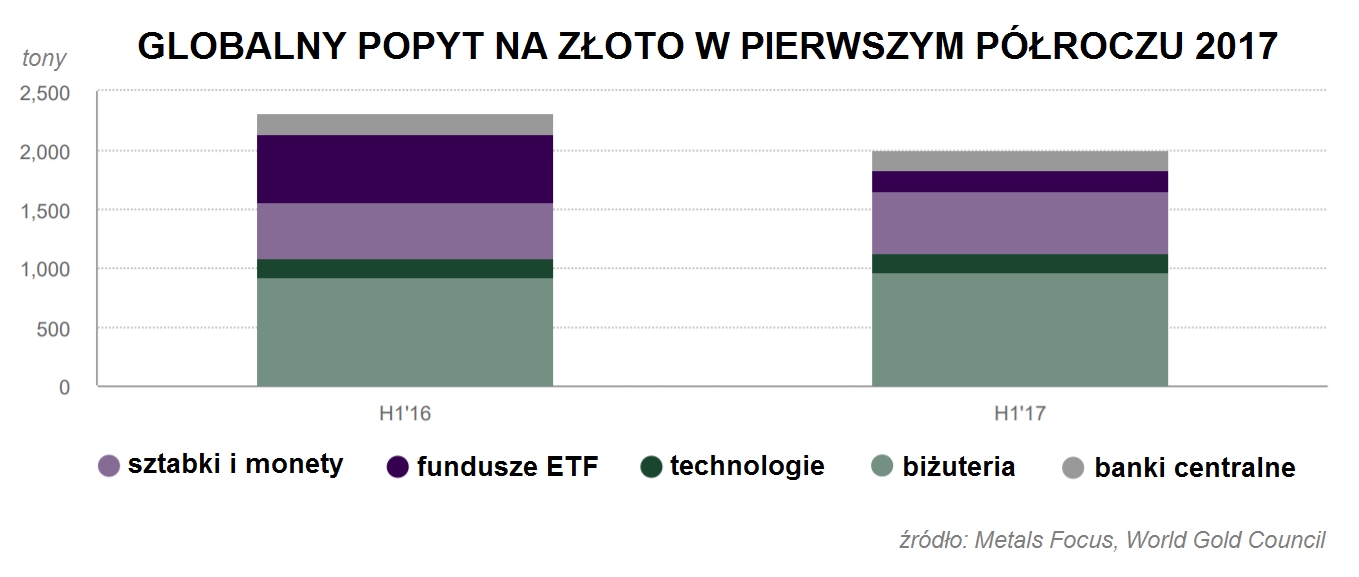

In the second quarter of this year, global demand for gold amounted to 953.4 tons, down 10 percent year-on-year, while in the first half of the year it was 2003.8 tons, down 14 percent, according to the World Gold Council (WGC) today.

However, when analyzing this data, experts point to the exceptionally high results in the comparable period of last year, when metal prices and geopolitical tensions particularly encouraged investors to invest their capital in safe assets. This makes it all the more interesting that even compared to H1 2016, demand for gold in the form of bars and investment coins has risen again.

PHYSICAL INVESTMENT GOLD

Compared to the same period last year, consumer demand for physical investment gold rose by 13% (240.8 tons) in the second quarter and recorded an 11% increase in the first half of the year. These results remain below the five-year average, but indicate continued interest in physical gold.

China (+56%) and India (+26%) contributed most to the growth in this sector, as did Turkey, which translated its exceptionally good economic performance and rising inflation into a huge increase in interest in gold among individual investors. According to the WGC, in the "other Europe" group, which includes Poland, 13.2 tons of gold bars and coins were sold in the first half of the year. Compared to the neighboring German market, where demand stood at 56.2 tons, it is clear that the Polish gold market still has considerable room for growth.

GOLD ETFs

In recent months, investors have been primarily guided by the Fed and ECB's monetary policy plans, as well as numerous geopolitical tensions. In the second quarter, as well as in the entire first half of the year, investments in gold-based ETFs slowed down significantly, although not everywhere. In the first half of the year, the funds received 167.9 tons, and their total value amounted to 2,313 tons (approximately $92.4 billion).

Although the second quarter saw a year-on-year decline of 76%, it stood no chance of achieving a good result compared to the record-breaking period of 2016. In the first half of the year, the price of gold in USD rose by 8%, which, compared to the same increase in 2016, slowed down purchases somewhat and increased the number of investors taking profits. Interestingly, European markets accounted for 76% of global purchases within ETFs during this period.

JEWELRY AND TECHNOLOGIES

The jewelry sector has picked up again in recent months, recording growth of 5% year-on-year in the first half of the year (+8% in the second quarter alone), although it should be noted that at 967.4 tons, the result remains relatively weak. According to WGC archives, there have only been three previous instances of half-yearly demand for gold from the jewelry industry falling below 1,000 tons.

The modern technology sector can also boast positive results, having increased its quarterly demand for gold for the third time in a row. Although the 2% increase and the result of 81.3 tons for Q2 are not staggering, it should be emphasized that the metal is finding new applications. Recently, many new studies have been published on the use of gold in medicine and in the development of renewable energy technologies, so further increases in demand in this field can be expected.

CENTRAL BANKS

Year-on-year, gold purchases by global central banks increased by 20%. In the first half of the year, these institutions increased their reserves by 176.7 tons. Russia was responsible for most of these transactions, with gold reserves now standing at 1,715.8 tons, accounting for 17% of the country's total foreign exchange reserves. Importantly, global central banks continue to set a good example for investors that gold should be treated as a long-term investment and refrain from selling the precious metal.

SUPPLY

According to WGC forecasts, gold supply fell in the past quarter, mainly due to a decrease in the amount of gold obtained from the secondary market (-18%). Gold production in mines in the first half of the year amounted to 1,557.1 tons, remaining virtually unchanged, but it is expected to start declining significantly in the next two years. Although several countries have recently seen an increase in production (Canada, Indonesia, Suriname), there are also countries that are already experiencing a decline in production (China, Tanzania, Mongolia). In the long term, the slowdown is likely to be more global in nature.

In terms of gold procurement from the secondary market, the decline is primarily due to a comparison with the strong period of last year, when the rapidly rising price of gold particularly encouraged consumers to sell their gold holdings. According to WGC experts, the current level of gold recycling is therefore more of a "normalization" of the situation than a real decline.

According to a report by the World Gold Council, investors are primarily guided by the economic and geopolitical situation, readily turning to gold as a "safe haven" in times of turmoil. They also take advantage of increases in the price of gold to realize their profits. Physical investment gold in the form of coins and bars remains the safest form of capital investment, and the fact that the supply of the metal is soon to decline should have a positive impact on gold prices.

Marianna Wodzińska

Head of Trading

Mennica Skarbowa S.A.

(1)_LBMA.jpg)

801 501 521

801 501 521