- Author of the entry: Mennica Skarbowa

- Date of entry:

Investing in diamonds? Investing in beauty

Diamonds are mainly associated with elegant jewelry, but alongside gold, they are the safest and increasingly popular form of investment.

The question arises: why is it worth investing in diamonds?

The price of diamonds has been steadily rising for decades, regardless of prosperity or crisis. This is due to the limited resources of diamond deposits in the world. What is more, only 15% of mined diamonds are suitable for use in jewelry. Following this principle, even fewer are suitable for investment purposes. In addition, the price is also influenced by the increase in demand for diamonds in Asian countries and the increasingly frequent treatment of diamonds as a means of diversifying investment portfolios.

Due to their continuous price increase, diamonds are considered a stable and safe investment in the medium and long term, as well as an excellent way to diversify an investment portfolio. They are a kind of universal currency, as their value is the same all over the world.

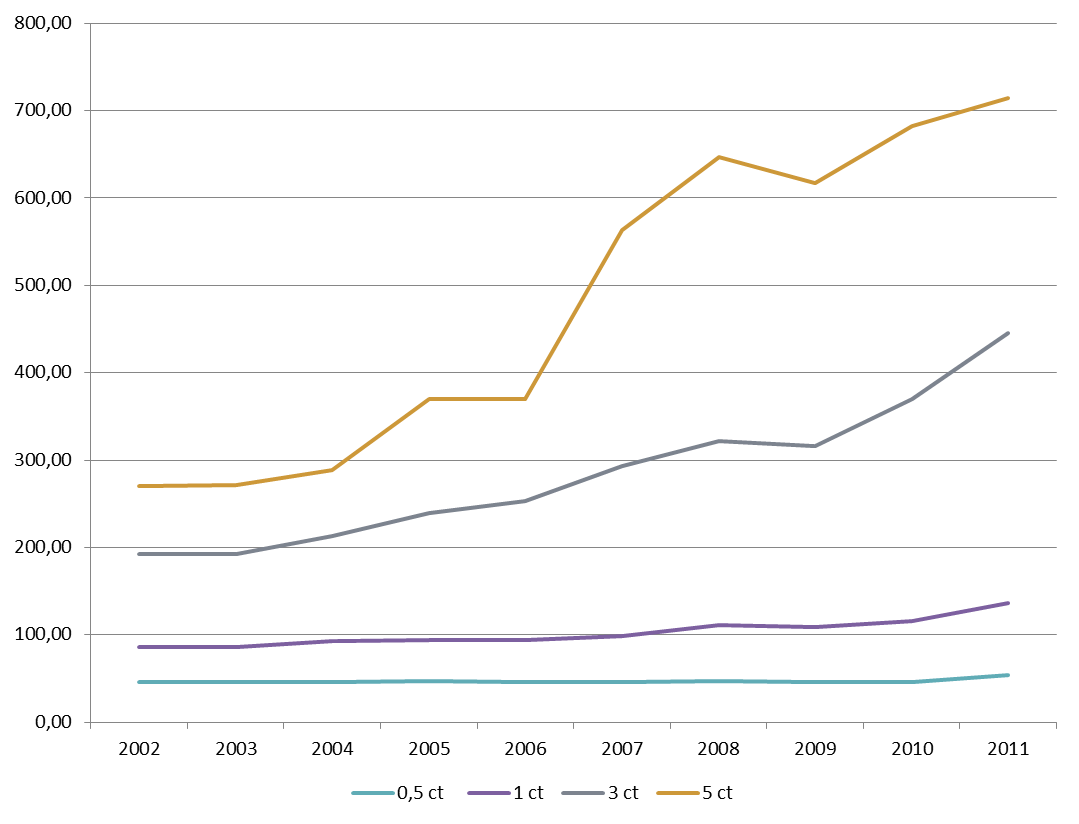

Price increases for larger diamonds are more significant.

Over the past 10 years, the increase in diamond prices has been as follows for stones of specific weights:

0.5 ct? 16.2% increase in value

1 ct - 59.1% increase in value

3 ct - 131.4% increase in value

5 ct - increase in value by 164.0%

In order for a diamond to generate a profit, the investment must be maintained for at least two years. It is assumed that in order for a diamond to be considered an investment, it should have a minimum weight of 1 carat, color: D, E, or F; clarity: IF, VVS1, or VVS1, due to the higher rate of return on investment. However, there are opinions that it is possible to invest in diamonds as small as 0.5 ct.

What is a diamond?

Diamond is an allotropic form of carbon and the hardest mineral found in nature, which makes it virtually indestructible. After being cut into a round shape, a diamond is called a brilliant, and its weight is measured in carats (1 ct = 0.2 g).

When investing in diamonds, it is important to remember the four characteristics of diamonds (4Cs), which all contribute to the final price of the stone. These are:

- Color (Colour)

- Clarity (Clarity)

- Cut (Cut)

- Weight (Carat)

The value of a given diamond can be checked in the Rapaport Diamond Report, which provides monthly international diamond prices. The value of a given diamond can be checked in the Rapaport Diamond Report, which provides monthly international diamond prices.

To facilitate global diamond trading, a certification system is used to confirm the parameters of a given stone. Some say that this is the fifth characteristic of diamonds (5Cs). Certificates are issued by gemological institutions. There are many institutions that certify diamonds, but only three of them are recognized and respected around the world. The most trusted ones include: GIA (Gemological Institute of America based in Los Angeles), HRD (Hoge Raad voor Diamant based in Antwerp), and IGI (International Gemological Institute based in Antwerp).

(1)_LBMA.jpg)

801 501 521

801 501 521