- Author of the entry: Mennica Skarbowa

- Date of entry:

Ochrona kapitału - inwestycje

Na przestrzeni lat Polacy przekonali się do tego, że oszczędności najlepiej inwestować, a nie trzymać w przysłowiowej skarpecie.

Można umieścić je na lokacie, jednak w sytuacji, gdy te oprocentowane są na około 5-6% w skali roku, a inflacja pozostaje na poziomie kilkunastu procent, trudno mówić o jakimkolwiek zarobku.

Popularną formą inwestowania przez lata był też zakup nieruchomości. To zarówno nabycie mieszkania pod wynajem, jak i tzw. „flipa”, czyli nieruchomości do remontu w niższej cenie, które po odnowieniu sprzedaje się z zyskiem. Jednak oprócz zalet w postaci wysokiej stopy zwrotu, jest również spory minus – wysoki próg wejścia.

Inwestycja w złoto – sposób Polaków na inflację

Czy można w dzisiejszych czasach wskazać inwestycję, która ma stosunkowo niski próg wejścia, a jednocześnie przynosi zwrot? Oczywiście, że tak. Do takich inwestycji należy kupno złota – to doskonały sposób na dywersyfikację portfela inwestycyjnego. Na start nie musimy mieć wysokiej sumy. Wystarczy już kilkaset złotych, aby zakupić złotą jednogramową sztabkę. Jednocześnie ceny złota w długoterminowej perspektywie pozostają w trendzie wzrostowym, zatem docelowo możemy liczyć na zysk.

Co wybierają Polacy?

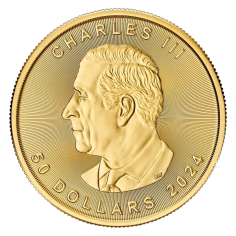

Zaletą inwestycji w złoto jest możliwość stałego poszerzania skali. Wystarczy co jakiś czas dokupywać kolejny produkt – sztabkę lub monetę bulionową – i w ten sposób poszerzać nasze zbiory. Pamiętajmy, że w przypadku zakupów inwestycyjnych kluczowa jest waga posiadanego złota, a nie rodzaj produktu, dlatego łatwo rozszerzać nasz portfel inwestycyjny poprzez kolejne transakcje.

Ostatnie miesiące jednoznacznie pokazały, że Polacy głównie kupują produkty o mniejszej gramaturze, np. 1, 5 i 10 gramów (choć popularne były też sztabki 100-gramowe). Trend ten zauważalny jest od momentu, gdy wybuchła wojna w Ukrainie. Mniejsza gramatura sprawia, że złoto jest łatwiej transportować i w razie potrzeby sprzedać - nie tylko w obrębie kraju, ale w dowolnym miejscu na świecie. Kupujący podkreślają też często opcję wymiany sztabki o mniejszej gramaturze na towary.

Prawdziwa gorączka złota

Niski próg wejścia, bezpieczeństwo, możliwość szybkiego zbycia i szansa na zysk w przyszłości. To tylko niektóre z zalet inwestycji w złoto, które doceniają Polacy. Wzrost zainteresowania zakupem złota pokazują wyniki, jakie w okresie lipiec-wrzesień osiągnęła Mennica Skarbowa.

Tylko w trzecim kwartale Mennica Skarbowa wygenerowała przychód na poziomie 280,4 mln zł. W 2021 roku za ten sam okres sprzedaż była niższa o 55,9 mln zł. Nominalnie sprzedaż w trzecim kwartale wzrosła z 920 kg w ubiegłym roku do 1,1 tony obecnie.

Patrząc szerzej na sprzedaż w całym 2022 roku już widzimy, że zmierzamy do kolejnego rekordu. Mennica Skarbowa sprzedała w tym roku już 3,5 tony złota, czyli więcej o prawie 30% w stosunku do roku ubiegłego

(1)_LBMA.jpg)

.jpg)

801 501 521

801 501 521