Your shopping cart

No products in the shopping cart

- Author of the entry: Mennica Skarbowa

- Date of entry:

The beginning of the week on the financial markets did not bring good news. A bomb attack in Russia caused stock indices to record losses (the US S&P500 index fell 0.2%). The sell-off was also visible in currencies classified as risky (including the Polish zloty) and commodity currencies (the Australian and Canadian dollars). Safe-haven assets gained, including gold, the Japanese yen, and 10-year US government bonds (yields fell to 2.33%). The main EUR/USD pair showed indecision.

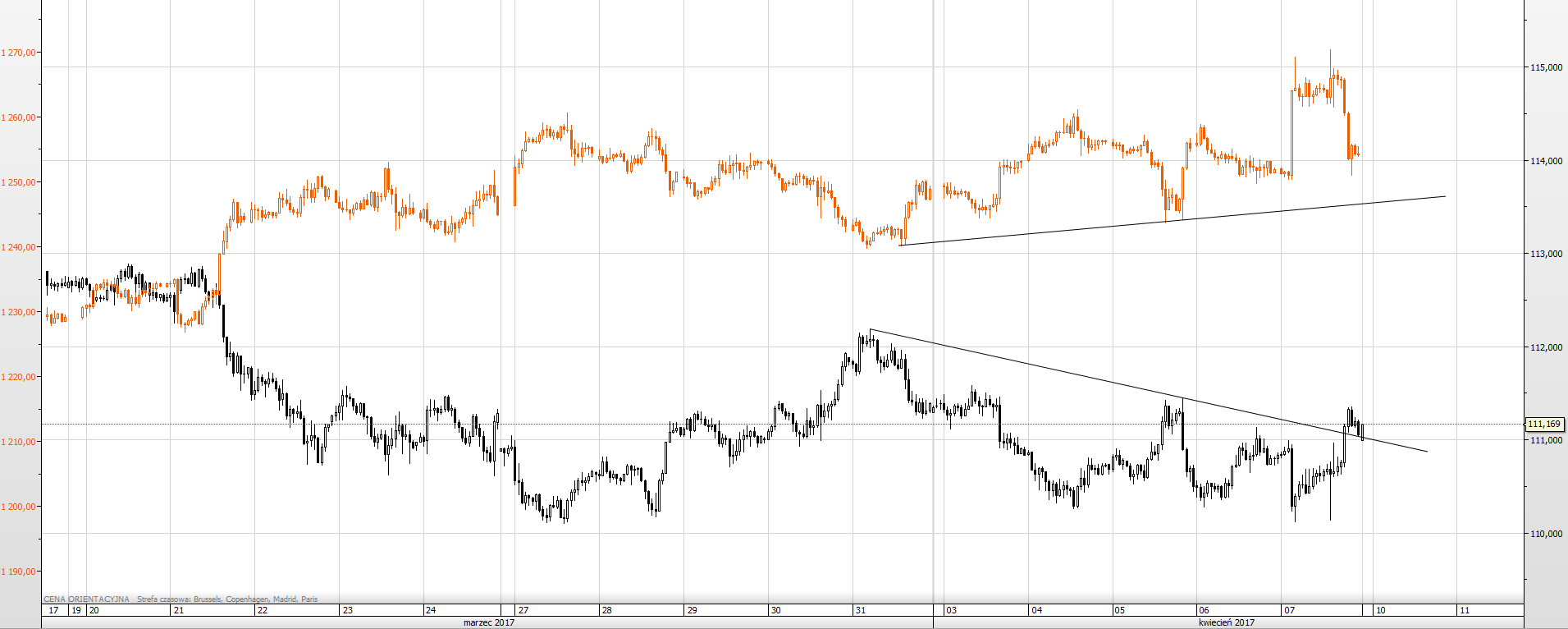

Last Monday, around 4 p.m., gold prices rose from USD 1,246 to USD 1,253 per ounce. Thus, from a technical perspective, the price broke out of the flag formation that had been developing over the previous week.

Last Monday, around 4 p.m., gold prices rose from USD 1,246 to USD 1,253 per ounce. Thus, from a technical perspective, the price broke out of the flag formation that had been developing over the previous week.

Chart 1: Gold (orange chart) and USD/JPY currency pair (black chart), hourly interval

On Tuesday, gold prices managed to rise to the local resistance level (USD 1,260/oz) set by the peak on March 27, but failed to break through it permanently. Strong technical levels and reduced risk aversion halted further gains in the metal. The price began a local correction, which completely wiped out Monday and Tuesday's gains.

In recent days, apart from the presidential debate in France, which did not bring anything interesting for the financial markets, the publication of the minutes from the last FOMC meeting and Friday's data from the US labor market were significant events.

On Wednesday evening, we learned that the Fed is beginning to seek to reduce its balance sheet, which has increased several times since the start of the global crisis. The dollar reacted to this news by losing value, the EURUSD pair rose from 1.0634 to 1.0680, gold again tested its weekly highs (USD 1,258/oz), and the S&P500 index fell by more than 1%. Earlier on Wednesday, the market received information about the situation on the US labor market published by ADP. The good reading and positive surprise helped the dollar and thus hurt gold prices.

At the end of the week, the precious metal began to gain again due to increased geopolitical tension in the Middle East. Overnight US attacks on Syria pushed precious metal prices to levels not seen since November 2016. Increased risk aversion is the perfect environment for this asset. For this reason, information about the situation on the US labor market (as it was the first Friday of the month) took a back seat. The data hurt the dollar and helped the zloty slightly. Although the unemployment rate fell to 4.5%, hourly wages rose less than expected (0.2%), and non-farm payrolls increased by only 98,000 new jobs.

Gold is moving in a strong short-term upward trend, which has been forming since mid-March. In the longer term, prices are in the middle of a long-term upward channel (which began in December 2016). Breaking through the USD 1,263/oz level opens the way for the metal to reach around USD 1,280/oz (resistance resulting from the downward trend line since July 2016). Breaking through this level will likely lead to an attack on the round USD 1,300/oz zone, which is also the upper limit of the upward channel.

Chart 2: Gold, 6-hour interval

Arkadiusz Kłosiński

Mennica Skarbowa S.A.

(1)_LBMA.jpg)

801 501 521

801 501 521