- Author of the entry: Mennica Skarbowa

- Date of entry:

Has the gold bubble burst?

Last week, several economists expressed their opinion that gold is an overvalued speculative bubble, which is currently bursting. However, such claims come as a big surprise to me, especially since I have the opportunity to observe what is happening on the market up close.

Firstly, these economists forget about Copernicus-Gresham's law, formulated as early as the 14th century (for those interested: https://en.wikipedia.org/wiki/Gresham%27s_law), which states that bad money drives out good money on the market. Today, we have a situation where investors around the world are accumulating gold and holding onto it because it is good money. On the other hand, they are trying to spend worthless pieces of paper with the $ logo on them as quickly as possible.

As a result of falling gold prices on the stock exchanges, purchases of physical gold are breaking records. On April 17, the U.S. Mint sold the most ounces of Gold Eagle coins in over three years (source: https://www.bloomberg.com/news/2013-04-18/u-s-mint-s-sales-of-gold-coins-soar-after-futures-slump.html). Turnover on the European market is also staggering, and some bars and gold coins are slowly becoming scarce. Of course, mints will soon adjust supply to demand, but it will take some time.

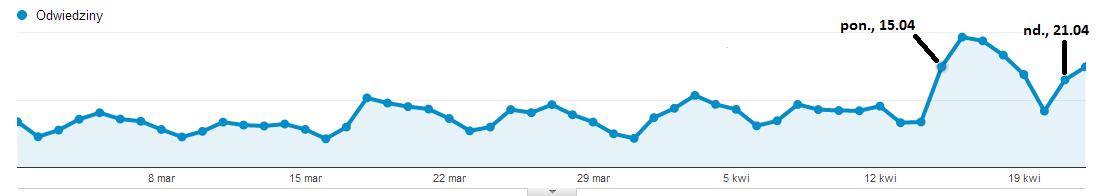

Visits to the online gold store www.MennicaSkarbowa.pl between March 1, 2013, and April 22, 2013.

Source: Google Analytics for www.MennicaSkarbowa.pl

The situation is identical among Polish gold dealers. Turnover has increased several times over. Even on weekends, increased purchases can be observed (through online stores). Interestingly, even the good weather during the last weekend did not cause a decline in interest, and on Sunday we saw record traffic for that day.

However, stock market prices are not responding to this increased demand at all. But that's because the stock market price depends on the game played by the biggest investment firms like Goldman Sachs, and what's traded there is the promise of gold delivery, not physical gold. On just one Monday, when the price on the stock markets fell by 9%, trading on Comex was almost equal to the annual gold production. In contrast, annual trading on Comex alone exceeds gold production fiftyfold. I would just like to point out that informed investors are beginning to realize this. Hence, among other things, this year we are seeing a sudden withdrawal of gold from Comex (a decline in reserves of over 20%)and incidents such as, for example, when at the beginning of the year the German Bundesbank first called on the United States to audit its physical gold reserves held at the Fed and then, when the Fed refused, the Bundesbank called for their return.

Importantly, gold is not bought for speculative reasons, but as a hedge against the risk of other assets losing value. This is evidenced, for example, by last year's record gold purchases by central banks (including very significant purchases by Russia and China) in 50 years. And they took place when the price of gold was at USD 1,600-1,700 per ounce (i.e., more than USD 200-300 above current price levels).

So, is gold overvalued? In my opinion, definitely less than other assets inflated by expansive monetary policy around the world (for example, the US stock market indices DJIA and S&P500 recently reached their historic highs). In addition, there is a high risk that all these bubbles will burst. After all, how long can you fight a crisis just by "printing money"? In that case, the only value may be gold, but only in physical form, i.e., bars or coins.

Bartłomiej Knichnicki, managing director of MennicaSkarbowa.pl

(1)_LBMA.jpg)

801 501 521

801 501 521