Your shopping cart

No products in the shopping cart

- Author of the entry: Mennica Skarbowa

- Date of entry:

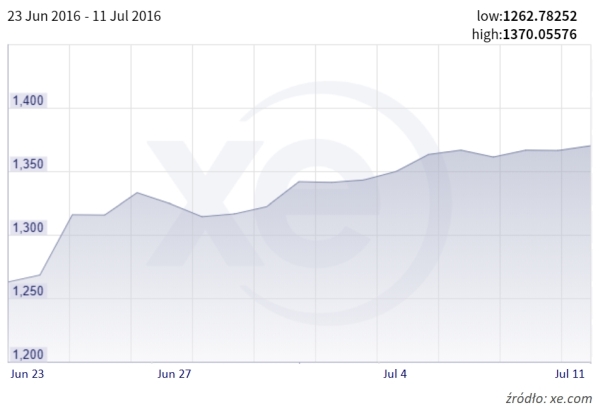

June 24, 2016 – the day after the unexpected result of the referendum on the United Kingdom's exit from the European Union, the price of gold began a real price rally. In just two weeks, the price of an ounce of gold in dollars rose by 8%, and in zlotys by as much as 12%. Once this historic event takes place, and especially if there is a so-called "hard Brexit," will gold prices rise again?

THE PRICE OF AN OUNCE OF GOLD IN USD IMMEDIATELY AFTER BREXIT

Regardless of how the tense situation surrounding Brexit, which has been ongoing for months, and the weeks of British parliamentary sessions end, gold is likely to benefit from the turmoil. As an asset traditionally associated with times of uncertainty, gold shines brightest against the backdrop of the most drastic solutions. Therefore, there is no shortage of investors who would prefer to see the British leave the EU without a deal.

At present – unfortunately for the British themselves – this is quite likely. Prime Minister Theresa May has only managed to postpone the date of leaving the EU until April 12, but the lack of agreement on the terms of the withdrawal does not bode well for the near future.

But could Brexit affect precious metal prices again? It turns out that it could, but only slightly, as the element of surprise is now behind us. According to analysts interviewed yesterday by Kitco, most scenarios have already been priced in by investors and factored into current precious metal prices.

"The biggest impact on the gold market in this case will be a significant change in the pound exchange rate, which could strongly affect British demand for gold," Ross Strachan, senior economist at Capital Economics, told the portal. However, he emphasized that the UK is a relatively small market compared to Asian countries or the US.

- Although the UK is a major center for precious metals trading, it is neither a major source of demand nor a major source of gold mining. Therefore, even large percentage changes in this small demand from the UK do not affect the dynamics of metal supply and demand, added the analyst.

- For a rally in gold to begin, there must first be a significant rally in the pound. If the pound rises, the US dollar should weaken, and on this wave, gold contracts should go up. We need to keep a close eye on the pound when the whole Brexit process is finalized, added Phillip Streible, senior market strategist at RJO Futures.

George Gero, managing director at RBC Wealth Management, shares this view, believing that Brexit's impact on the pound is what matters most for gold.

- Whether Brexit is hard or negotiated makes a big difference. If it is a hard exit, its impact on gold could be much greater, due to the sale of bullion to support the pound.

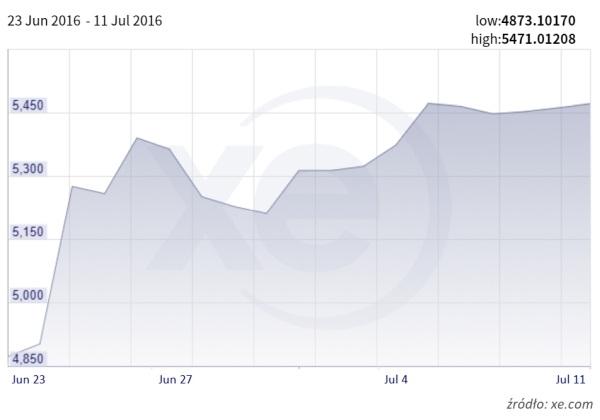

As the data in the chart below reminds us, the price of gold in our domestic currency, although following the same trend, can sometimes bring even bigger surprises than in the West. That is why we should pay even closer attention to gold prices in PLN in the near future.

THE PRICE OF AN OUNCE OF GOLD IN PLN IMMEDIATELY AFTER BREXIT

(1)_LBMA.jpg)

801 501 521

801 501 521